It’s no secret that a large number of older legal documents are defective. What might surprise you is that our latest estimate indicates anywhere up to 50% of the documents we receive from firms contain flaws. Some of them are minor, but many are potentially fatal.

The impact on accountants, wealth advisors and your clients is significant, and this problem is not a new one. It can stretch back decades, going un-noticed or ignored for many years.

What’s Changed?

Until now, correction of defects has largely been optional – although recommended – except where a third party requires it. However, from 1 July 2026 it becomes mandatory under the Federal Government’s new Anti-Money Laundering and Counter-Terrorism Financing Legislation (AML/CTF).

Because banks have been subject to these rules for some time, increasingly they have become more vigilant in identifying defects in documents presented to them in the course of business. Many clients will already be familiar with bank demands to correct sometimes innocuous errors which are picked up because identification documents (e.g. passports, drivers’ licences) do not exactly match the information provided to them.

These might include:

- incorrect spelling of names or other information

- missing full stops or a hyphen from a hyphenated name

- a change of name due to marriage or other

- missing ACNs

- incorrect execution of deeds

- missing dates or trust deeds that are dated before the date of incorporation of a corporate trustee

In most cases we can assist in the correction of any defective documentation by using a confirming deed (Deed of Ratification). This is an instrument which acknowledges the errors and confirms the validity and effectiveness of the actions taken by a trustee or other parties, notwithstanding the defect.

What You Can Do

Every day our team carefully checks all information provided to us and corrects it at the source for new structures. We also carefully check any re-structure request to ensure an exact match to the source documentation.

It’s older documents we’re not seeing that could potentially lie in wait for clients. We recommend all practitioners and clients examine older or existing documents to ensure they are compliant well before the 1 July deadline.

Real World Stories

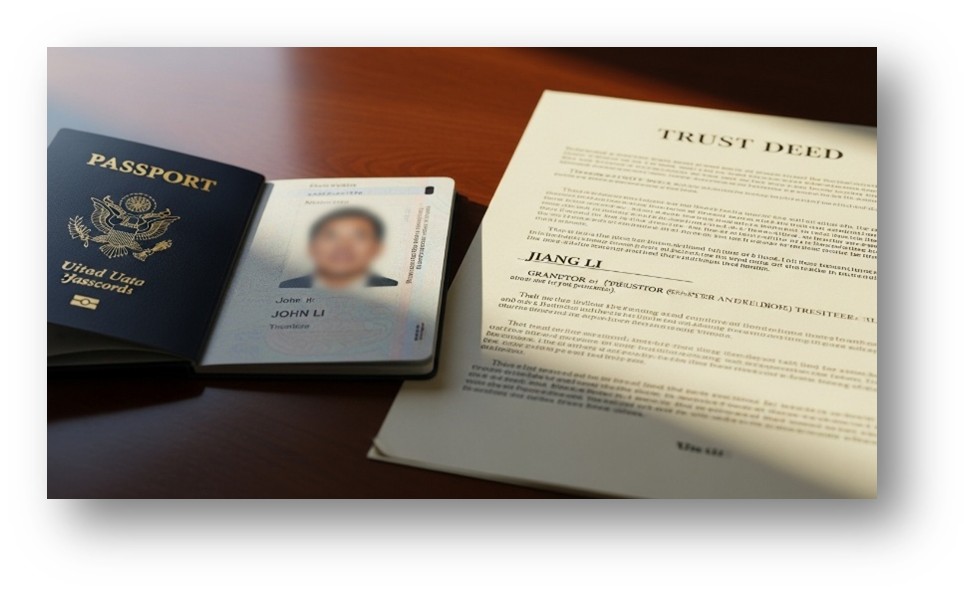

Common Issue #1: Inconsistent Identities

One of our clients is the sole individual trustee of a Trust which was established 20 years ago, shortly after he migrated to Australia. He informed us that the accounts team facilitating a bank account for his Trust found inconsistencies when they analysed his passport, driver’s licence and other personal identification documents. This included a difference between his legal name, Jiang Li*, and the Trust Deed where his anglicised name appears as John Li*.

The bank informed our client that he had 7 days to fix the issue, otherwise they would freeze his accounts.

Our legal services team recommended that we prepare a Deed of Ratification to satisfy the banks concerns.

In this deed, we:

acknowledged that the name of a person in the Trust Deed is incorrectly recorded as John Li and should be Jiang Li;

ratified the Trust Deed and all acts of the Trustee undertaken or effected in the period since the date of the establishment of the Trust; and

required that parties to the Deed of Ratification ratified and confirmed that all of the trustee’s previous acts in relation to the Trust were valid and effective, and that none of the parties would raise the issue of the incorrectly recorded name to avoid the consequences of any act performed on behalf of the Trust

Common Issue #2: Lack of Compliance

A bank’s legal team identified that a person who was sole director of a Company executed a trust deed in 2020 and advised that the execution was “in accordance with s127 of the Corporations Act”.

While the Corporation Act changed in 2022 to allow for a proprietary company which has a sole director to execute a deed, the execution of the Deed by a sole director who was not also the sole secretary of the Company was not specifically sanctioned under section 127 of the Corporations Act at the time of the establishment of the Trust in 2020.

To resolve the issue, the Bank’s legal team recommended that our client provide a Deed of Ratification.

We drafted a document which:

acknowledged the issue and stated that the execution by the Trustee may be defective; and

ratified the execution of the Trust Deed by the Trustee, confirming that all acts of the Trustee undertaken or effected in the period since the date of the Trust are valid and enforceable.

In a positive outcome for the client, the bank was satisfied with the Deed of Ratification, and the parties could proceed to settlement.

We are here to help with any issues you identify in older documents, including preparing a Deed of Ratification if required. Please get in touch with our Legal Services team today.

Speak to our PantherCorp team today

We’re always here to help, and we’re ready when you are.

If you want to discuss anything with us, book a demonstration of our platform or order any of our legal documents, just reach out.

Email order@panthercorp.com.au or phone 08 9388 0551.

*All names have been changed to protect the privacy of our clients.

Disclaimer: This article is for general information purposes only and does not constitute legal, accounting or financial advice in any context or application. It is also not intended as financial advice. You should seek independent professional advice relevant to your specific situation before acting or relying on any of the information contained herein.